Get to know your Medicare coverage - What is it and how can you use it?

REMEMBER!

- Original Medicare (Parts A & B) counts as a Medicare plan that you receive once you turn 65. Original Medicare does not cover everything. Routine prescription drugs, dental, eye care, and hearing are a few services that are outside the scope of this plan.

- You typically have to pay the deductible for your medical insurance coverage before Medicare pays its share. Medicare will then take over the payments and you will pay coinsurance or copayment for completed healthcare services and supplies.

- Some Medicare insurance plans are optional and may become available during select times of the year. A Medicare Supplement plan, a Medicare Advantage plan, a Medigap policy, and Part D prescription drug coverage can all be included. These plans differ by location and may be adjusted in terms of coverage.

Understanding Medicare Coverage Plans: What You Need to Know

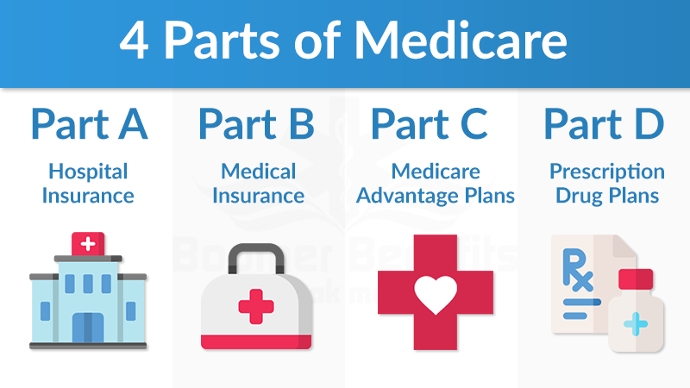

Medicare has four parts, which are arranged from A to D alphabetically.

Medicare Advantage plans have geographic restrictions, meaning you must reside within their designated service area to be eligible for enrollment.

Original Medicare is administered by the US government. American citizens are typically eligible to enroll in Original Medicare when they reach the age of 65. It is split into Parts A and B, which each handle distinct pieces of your health care.

Remember that Original Medicare does not cover everything such as vision and dental care.

Medicare Part A

Medicare Part A is a hospital insurance scheme. It reimburses the costs incurred at a hospital or skilled nursing facility but does not pay for long-term care.

- In-patient in a hospital

- Inpatient in a skilled nursing facility

- Home health care

- Hospice care

Medicare Part B

Medicare Part B is a medical insurance plan that covers doctor visits. It also covers the expenses of medically required and preventive care, as defined by CMS.

Medically essential services are those that are required to diagnose and treat your medical condition, such as supplies, tests, or other services. Preventative services are healthcare services that are needed to diagnose and treat a problem early on.

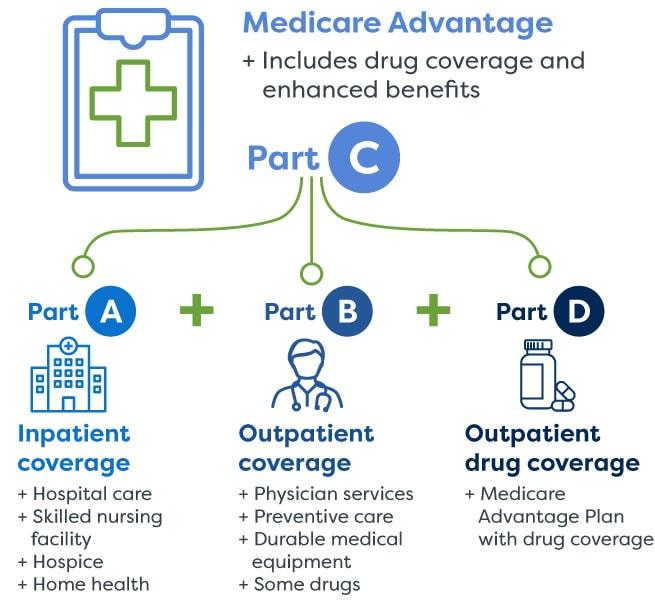

Medicare Advantage Plans (Part C)

Part C of Medicare, generally known as Medicare Advantage, is a type of private insurance. Part C enrollment is entirely optional.

Prescription medication coverage is included in most Medicare Advantage plans. Medicare Advantage plans may additionally provide vision, hearing, and dental coverage in addition to what Original Medicare plans provide.

1. Prescription Drugs

2. Dental Coverage

3. Vision Coverage

4. Other Additional Benefits

Medicare Part D, which is supplied by private insurance, covers the cost of prescription medications. Part D enrollees must pay a monthly premium. It covers prescription medications purchased from a local or mail-order pharmacy.

For Part D coverage, most states have more than a dozen private insurers to select from. Prescription medication coverage is frequently available through a Medicare Advantage plan, which combines Parts C and D.

You can also buy a separate medication plan to go with your Original Medicare. Different Part D plans have their own formularies, and the medications they cover may differ slightly.

A Medicare Supplement plan sometimes referred to as Medigap, is a supplement to Original Medicare that provides additional coverage.

Only 80% of services are covered by Medicare Parts A and B. The remaining 20% is covered by a Medigap plan, which eliminates coinsurance and copayments as well as certain extra out-of-pocket expenses.

What can Medigap cover?

Deductibles > Coinsurance > Copayments

Private insurance firms sell these products. You can't combine Medicare Advantage with supplementary insurance if you have Medicare Advantage. Medigap is solely intended to supplement Original Medicare coverage.

It's critical to be aware of and analyze all of your options while looking for the best Medicare plan for you. Knowing the difference between each type of plan can help you determine the plan that you need.

Types of Coverage

- Original Medicare

- Medicare Advantage

- Medigap

- Part D Prescription Drug Coverage

One of the first things you should consider when comparing plans is how much money you are willing or able to pay for health care coverage. This will assist you in narrowing down your initial choices.

You should also establish a note of any specific ailments or services that you require and that should be included in your plan. It might help you decide whether Medicare Advantage is the best option for you if you have coverage needs that aren't met by Original Medicare.

If you choose Medicare Advantage, you'll also have to think about where you reside. The plans are regionally available and may be different for each city. If you reside in populous regions, you will most likely have more possibilities.

Medicare Advantage and Part D plans are also given a star rating based on the services they provide and how effectively they perform.

Medicare Plan - how to choose

1. Calculate how much you can afford to spend on health care.

2. Determine which treatments, services, or insurance coverage are most essential to you.

3. Check Original Medicare and Medigap plans.

4. In your location, you may compare Medicare Advantage and Part D plans.

5. Compare the ratings of various plans.

6. It's also crucial to compare plans year after year during enrollment periods. Year after year, the coverage and plans offered near you may vary, bringing up new and maybe better coverage possibilities.

Enrollment and Eligibility for Medicare

Medicare Parts A and B are not available to everyone. Others may still be able to get it if they pay a fee.

Requirements to qualify for premium-free Medicare Part A at age 65 or older:

1. You or your spouse worked for the government and were insured by Medicare.

2. You or your spouse have worked long enough (typically 10 years) and paid Medicare taxes to be eligible for Social Security.

3. Social Security or the Railroad Retirement Board provides you with retirement benefits. Alternatively, you may be qualified for Social Security or Railroad benefits but have not applied for them.

You may be eligible for Medicare Part A coverage if you or your spouse did not pay Medicare taxes while working and are 65 or older and a US citizen or lawful permanent resident.

If you are under 65 and require dialysis or have had a kidney transplant, you may be eligible for premium-free Medicare Part A. Anyone diagnosed with Lou Gehrig's disease (ALS) younger than 65 is also eligible for the first month after getting disability Payments.

If you are qualified for Original Medicare and are currently receiving Social Security payments, you will be automatically enrolled when you reach 65.

Pro Therapy Supplies is proud to announce that we are accepting Medicare and Commercial Health Insurance! For inquiries, you may call us at 770-441-9808.